Financial agreement template for medical office, When you choose to venture into a new business with a friend or a spouse, it is essential that you look at establishing a partnership arrangement. However well you know the people you are about to startup a company with, conflicts down the street are unavoidable. Because people don’t think about establishing such a kind of legal arrangement at the beginning, many struggles and legal problems then arise. Having a partnership agreement, all parties involved can feel secure as they’re mindful of just how problematic issues will be taken care of.

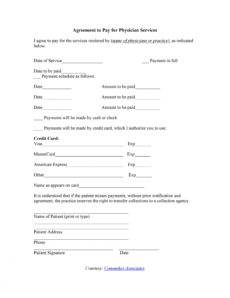

The basic element of any company arrangement is the mutual benefit that the business relationship is predicted to bring to the contracting parties. Therefore, the solution or service to be offered by party A and the compensation that it will receive in return is in the center of the business agreement. The obligations of all parties concerned have to be said unambiguously. By way of instance, sellers’ duties such as criteria to be followed, quality checks to be instituted and delivery deadlines to be met has to be carried out. Likewise, a business arrangement might list down the buyers’ duties such as providing clear specifications, issuing timely instructions . It’s very important to be aware that many disputes arise from a lack of consensus about whether company obligations have been met.

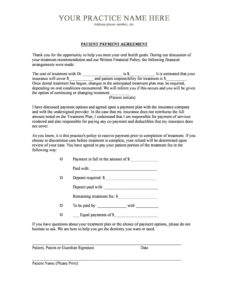

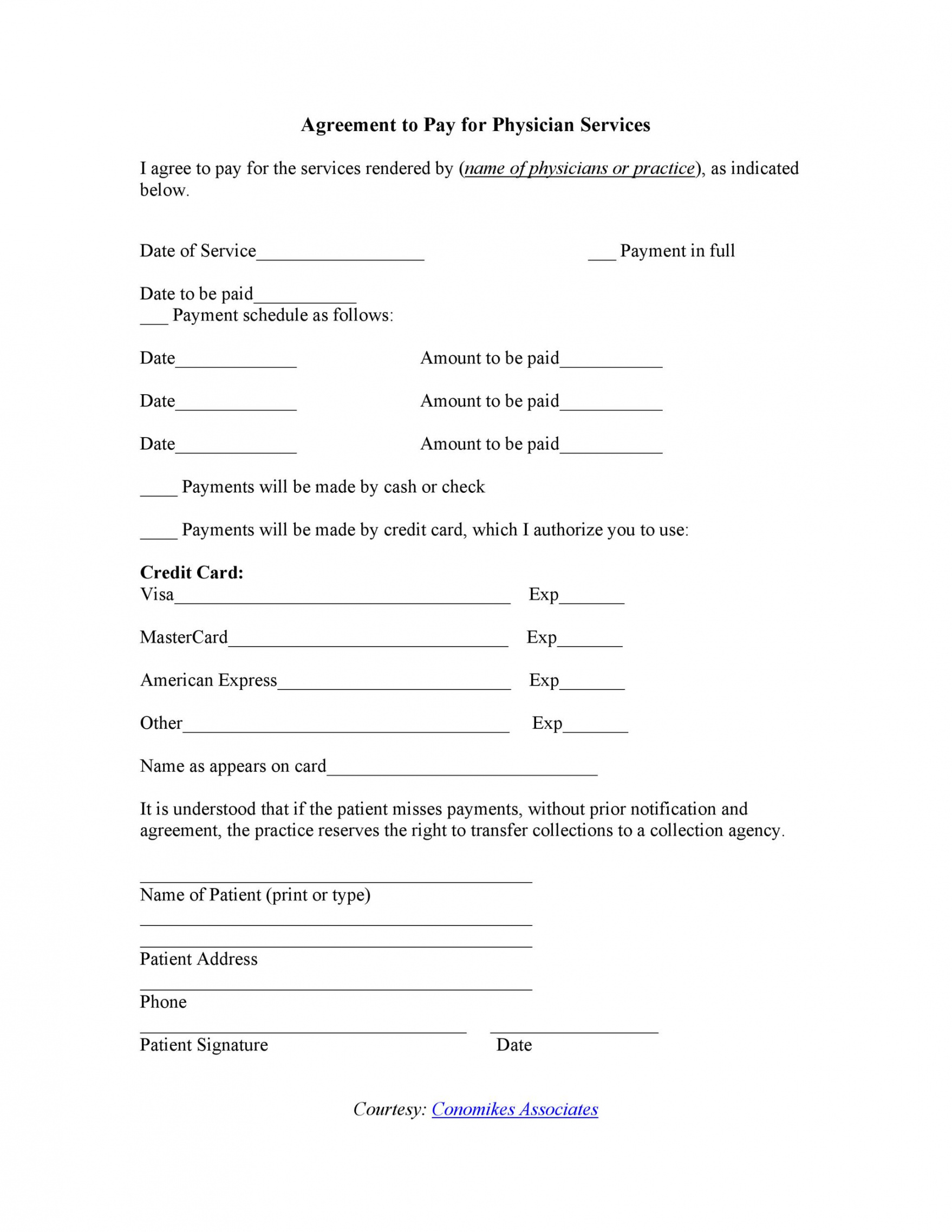

Payment conditions are another component of a business agreement that has to be treated with caution. The receiver must make sure that the contract covers relevant details such as the mode and frequency of payment, pre-requisites for making the paymentdetails of their remitting party and so on. In instances of dispute, it’s certain that the paying party will look for loopholes in the company agreement which will allow them to withhold payment; hence the recipient must make certain that the conditions are watertight in this respect.

A business arrangement will also define the consequences in case of a breach of contract. The rights of the injured party, the liabilities of the defaulter and the legal authority that will apply – all of these have to be included. Of specific importance is liability, and every contracting party will attempt to change up to it as possible to another. There are particular legal ways to restrict liability – exception of indirect damages and capping how much has to be paid under some circumstances, are just two examples.

Typically, a business agreement will prefer the party that’s drawn this up. Therefore, the other parties involved must make certain that their interests are safeguarded also. It is important to have the contract vetted by an attorney who specializes in that area of law. Having done that, before signing on the dotted line in almost any business agreement, it’s vitally important to go through it carefully and ensure that it does not have any vague provisions and agreed terms have been incorporated. Firms like Nolo provide do-it-yourself legal services that may help entrepreneurs with no legal qualifications get a better understanding of how to interpret a company contract.