Navigating the job market can often feel like a complex loan application in itself, especially when you’re aiming for a specialized role like a mortgage loan processor. Your resume isn’t just a document; it’s your first, and often only, chance to make a powerful impression on potential employers. It needs to clearly articulate your skills, experience, and the unique value you bring to the table, cutting through the noise to showcase why you’re the perfect fit.

A well-structured and compelling resume can significantly boost your chances of landing that coveted interview. It’s about more than just listing duties; it’s about highlighting achievements, demonstrating proficiency in industry-specific software, and showing a deep understanding of the loan lifecycle. This article will guide you through creating a resume that not only gets noticed but truly stands out in a competitive field.

Crafting a Standout Mortgage Loan Processor Resume

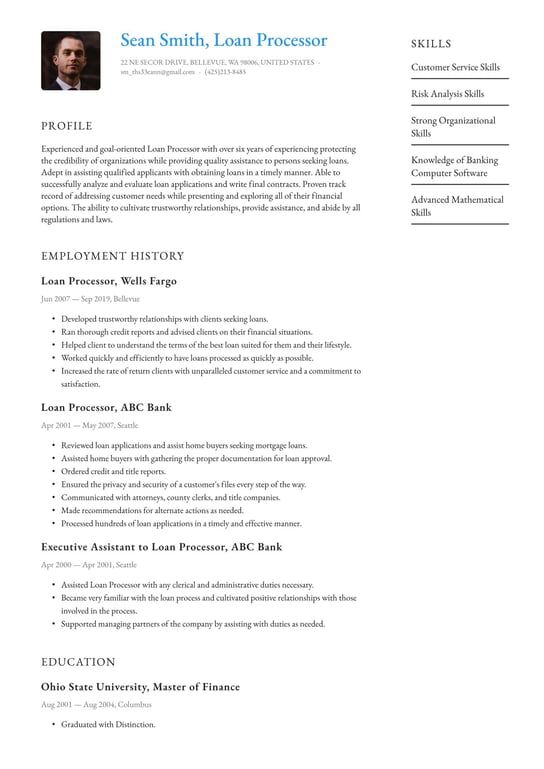

Building an effective resume requires a strategic approach, particularly for a detail-oriented role like a mortgage loan processor. Your document should flow logically, starting with your contact information, followed by a powerful professional summary, a detailed work history, a relevant skills section, and finally, your educational background. Each section offers an opportunity to impress, so let’s explore how to maximize their impact.

The professional summary is your elevator pitch – a concise 3-4 sentence overview of your career highlights, core competencies, and career objectives. For a mortgage loan processor, this means emphasizing your experience with various loan types, your knowledge of compliance, and your efficiency in processing applications. Think about what makes you unique; perhaps you excel in fast-paced environments or have a knack for problem-solving complex loan scenarios.

When detailing your experience, don’t just list responsibilities. Instead, focus on accomplishments. Use strong action verbs like "managed," "streamlined," "analyzed," or "facilitated." Quantify your achievements whenever possible. Did you process a certain number of loans per month? Did you reduce turnaround times? Did your accuracy contribute to higher approval rates? Numbers speak volumes and demonstrate your tangible contributions.

Key Skills to Highlight

For a mortgage loan processor, a robust skills section is non-negotiable. This is where you demonstrate your technical expertise and soft skills crucial for the role.

- Technical Skills:

- Loan Origination Systems (LOS) like Encompass, Calyx Point, or BytePro

- Underwriting guidelines (FHA, VA, Conventional, USDA)

- Compliance regulations (TRID, RESPA, HMDA)

- Mortgage insurance and credit reports

- Microsoft Office Suite (Excel, Word, Outlook)

- Database management

- Soft Skills:

- Attention to detail

- Communication (written and verbal)

- Problem-solving

- Organizational skills

- Customer service

- Time management

- Analytical thinking

Remember, an employer is looking for someone who can hit the ground running, and a comprehensive skills list, backed by your experience, paints that picture perfectly.

Leveraging Your Mortgage Loan Processor Resume Template Effectively

While a mortgage loan processor resume template provides an excellent foundation, its true power lies in how you customize and refine it for each specific job application. Think of the template as a starting point, not a rigid blueprint. Each job description offers clues about what the employer values most. Tailoring your resume means aligning your skills and experiences with their stated requirements, using keywords from their listing, and demonstrating that you’ve done your homework.

Once you’ve adapted the content, pay close attention to the formatting and presentation. A clean, professional design ensures readability and leaves a positive impression. Use clear, consistent fonts and appropriate white space to avoid a cluttered look. Remember, many companies use Applicant Tracking Systems (ATS) to filter resumes. An ATS-friendly design avoids complex graphics or non-standard fonts that could confuse the system, ensuring your resume makes it past this initial screening.

Proofreading is an absolute must. Even a single typo or grammatical error can undermine your professionalism and attention to detail, qualities that are paramount for a mortgage loan processor. Read your resume aloud, or better yet, ask a trusted friend or mentor to review it for clarity, conciseness, and accuracy. A fresh pair of eyes can often catch mistakes you’ve overlooked.

Finally, remember that your resume is just one piece of the puzzle. While a strong mortgage loan processor resume template will open doors, a compelling cover letter, a professional LinkedIn profile, and strong networking efforts all contribute to your overall job search success. Each element should work in harmony, presenting a consistent and powerful narrative of your capabilities and career aspirations in the mortgage industry.

Crafting a resume that truly reflects your capabilities and aspirations is an investment in your career. By meticulously presenting your experience and skills, you not only improve your chances of securing interviews but also lay the groundwork for a successful career in mortgage processing. Your dedication to creating a polished document mirrors the precision and thoroughness required in the role itself.